Chapter 12 Accounting for Partnerships Test Bank

These Multiple Choice Questions have been prepared based on the latest CBSE and NCERT syllabus for Class 12 Accounts. Chapter 12 Partnerships 1 Mutual agency in a partnership means that partnership decisions may be made by any one of the partners.

Chapter 12 Accounting For Partnerships

Close suggestions Search Search.

. Scribd is the worlds largest social reading and publishing site. Chapter 12--Accounting for Partnerships and Limited Liability Companies Key 1. An Introduction to Accounting Chapter 2.

Test-bank-accounting-25th-editon-warren-chapter-12-accounting-forpdf - Free download as PDF File pdf Text File txt or read online for free. A partnership is an association of no more than two persons to carry on as co-owners of a business for profit. This documentTEST BANK Contains 213 Questions With Answers Worked Solutions and Essay Explanations.

Sampsons capital account balance should be 102000 comprised of land 65000 and equipment 57000 less debt 20000. Accounting Information Systems Chapter 8. There are only four legal structures to form and FA Test Bankpdf - Chapter 12-Accounting for Partnerships.

Xem và tải ngay bản đầy đủ của tài liệu tại đây 117 MB 38 trang Chapter 12 Accounting for Partnerships PowerPoint Authors. Test Bank for Accounting Principles Eleventh Edition. There are only four legal structures to form and operate a business.

The purpose of this article is to assist candidates to develop their understanding of the topic of accounting for partnerships. Accounting for Corporations Chapter 14. Current Liabilities and Payroll Accounting Chapter 12.

Suits The C-Suite -- By Veronica R. 640 2 Accounting for a partnership is similar to accounting for a proprietorship. Open navigation menu.

665 3 A partnership agreement may be oral. Accounting for Receivables Chapter 10. Basic accounting test bank chapter 12 accounting for partnerships summary of questions study objectives and taxonomy item so bt item so bt item so bt item so.

This documentTEST BANK Contains 213 Questions With Answers Worked Solutions and Essay Explanations. Identify the characteristics of the partnership form of business organization. 5 1 2 2 3 1A 1B 3.

CHAPTER 12 ACCOUNTING FOR PARTNERSHIPS SUMMARY OF QUESTIONS BY LEARNING OBJECTIVES AND BLOOMS TAXONOMY Ite LO BT Ite LO BT Ite LO BT Ite LO BT Item L BT True-False Statements 1. 12-1 Identify the characteristics of a partnership. Plant Assets Natural Resources and Intangibles Chapter 11.

School Lahore School of Economics Lahore Course Title ACCOUNTING 112 Uploaded By ahmedsaleemlse Pages 416 Ratings 100 2. Test Bank for Introductory Financial Accounting for Business 2nd Edition Thomas Edmonds Christopher Edmonds Mark Edmonds Jennifer Edmonds Philip Olds ISBN10. Test Bank for Introductory Financial Accounting for Business 2E Edmonds.

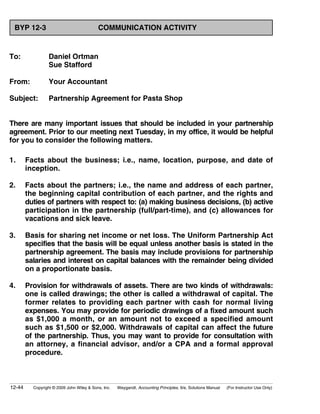

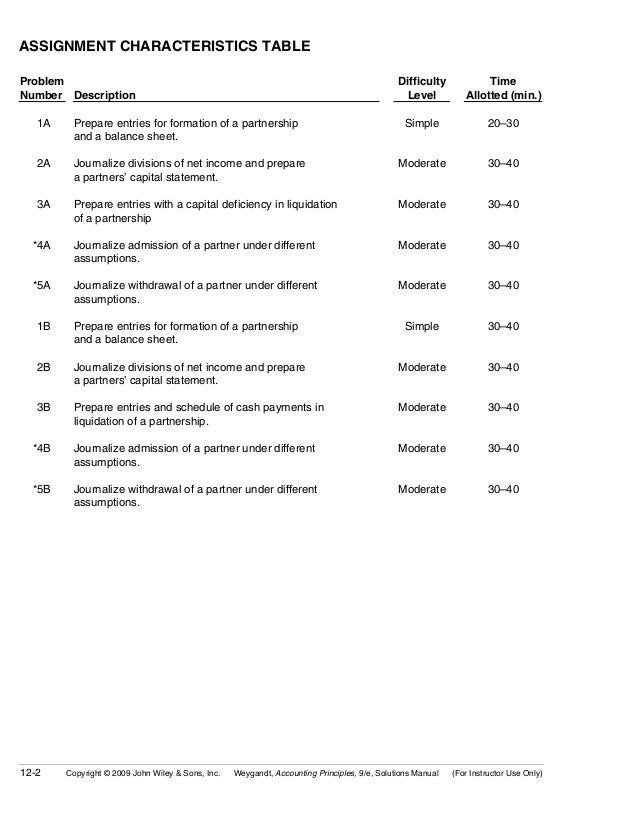

Test bank Accounting 25th Editon Warren Chapter 6-Accounting for Merchandising Businesses Test bank Accounting 25th Editon Warren Chapter 16-Statement of Cash Flows Test bank Accounting 25th Editon Warren Chapter 17-Financial Statement Analysis. CHAPTER 12 Accounting for Partnerships ASSIGNMENT CLASSIFICATION TABLE Study Objectives Questions Brief Exercises Exercises A Problems B Problems 1. Horngren Chapter 12 Partnerships Objective 12-1 1 Mutual agency in a partnership means that partnership decisions must be made mutually by both partners.

Shekhar Pd2 Hurley Corporate Partnerships Corporate partnerships allow schools to gain extra cash by advertising a product or service around the school this allows the school to gain extra money and the company possible sales. Test Bank Chapter 12 Accounting for Partnerships and Limited Liability Companies 1. Explain the accounting entries for the formation of a partnership.

Students of class 12 Accountancy should refer to MCQ Questions Class 12 Accountancy Accounting for Partnership Basic Concepts with answers provided here which is an important chapter in Class 12 Accountancy NCERT textbook. CHAPTER 12 ACCOUNTING FOR PARTNERSHIPS SUMMARY OF QUESTIONS BY LEARNING OBJECTIVES AND BLOOMS TAXONOMY. FA Test Bankpdf - Chapter 12-Accounting for Partnerships and Limited Liability Companies Student.

Buy now to view the complete solution. 1 2 3 4 12 1 2. Test Bank for Accounting Principles Eighth Edition 12 - 2 14.

As such it covers all of the outcomes in Section H of the detailed Study Guide for FA2It also provides underpinning knowledge for candidates studying FFAFA but it is not intended to comprehensively cover the detailed Study Guides for those exams. Test Bank for Accounting Principles Eleventh Edition. There are only four legal structures to form and operate a business.

Instructors Test Bank for Hospitality Financial Accounting 2nd Edition Jerry J. In a general partnership each partner is individually liable. PARTNERSHIP AND CORPORATION ACCOUNTING TETSBANK PRACTICE MATERIALS chapter 12 accounting for partnerships summary of questions study objectives and taxonomy.

RELATED STORIES Wider PPP platform available e-PhilHealth project eyed. In a general partnership each partner is individually liable to creditors for debts incurred by the partnership to the extent of the partners capital balance. Once assets have been invested in the partnership they are owned jointly by all partners.

CHAPTER 12 ACCOUNTING FOR PARTNERSHIPS. 111 Evaluates financial reporting needs Objective. Chapter 12--Accounting for Partnerships and Limited Liability Companies.

When the partnership agreement does not specify the division of net income or net loss net income and net loss should be divided equally. CHAPTER 12 ACCOUNTING FOR PARTNERSHIPS. Each partners initial investment in a partnership should be recorded at.

Lecture Principles of financial accouting - Chapter 12. Hospitality Financial Accounting 2nd Edition Weygandt. The supporters of corporate partnerships argue that it is a necessity for cash stripped schools.

Pore Accounting for public-private partnerships In order to carry out the challenge and responsibility of developing and improving public infrastructure government intends to collaborate with the private sector through the public-private partnership PPP program. Bạn đang xem bản rút gọn của tài liệu. 10000 5000.

Accounting for Partnerships Chapter 13. Cash and Internal Controls Chapter 9.

Chapter 12 Accounting For Partnerships

Chapter 12 Accounting For Partnerships

Chapter 12 Accounting For Partnerships Principles Of Accounting Ii Instructor Bruce Fried Cpa Syllabus Questions On With The Course Ppt Download

Chapter 12 Accounting For Partnerships

0 Response to "Chapter 12 Accounting for Partnerships Test Bank"

Post a Comment